There was an interesting article in this week’s Barron’s https://www.barrons.com/articles/where-to-find-safe-5-yields-1527780368 (the subscription is needed to read it).

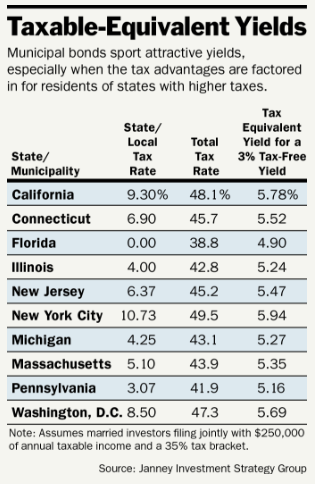

It talked about how great munis are as an investment because the average muni-bond yield of 2.5% is actually about 5% on an apples-to-apples basis with the regular taxable corporate bonds.

Here is the table from the article:

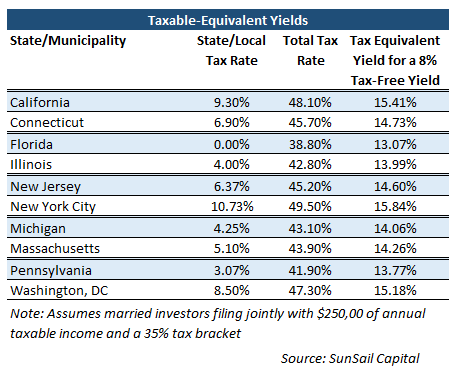

Of course, it got me thinking about multifamily syndications’ deals that we see (and invested in). The returns for the passive investor that we and many other syndicators that pursue our strategy (often referred to as “value-add”) target are 8%+ “cash on cash” (annual distributions as % of equity invested) and 16-18% IRR (includes cash on cash + capital gains). Very often in apartment deals, due to the fact that the interest on the debt is tax deductible, and so is depreciation (and it can be accelerated), the taxable income over the course of the average holding period of five years is negative resulting in the effective tax rate of 0%. So….naturally, we wanted to recreate the table from the article and look at tax-equivalent yields for multifamily investing! See below.

Isn’t it amazing?! For me, living in NYC, that alone is a reason to get excited about multifamily investing. And even if there IS taxable income leftover, in most cases it will be taxed at passive income tax rates, which are lower (needless to say, you should always consult your CPA).

As an additional bonus, when the apartment complex is sold after a few years, the capital gains and depreciation recapture are taxed at lower tax rates if we take a similar model investor as in the Barron’s example (married investors filing jointly with $250K annual taxable income). The details are beyond the scope of this article but it is clear that the tax advantages of real estate investing are very significant.

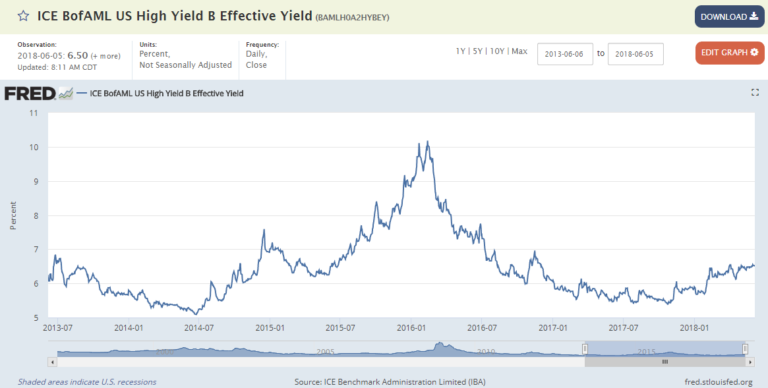

Now…I can see some of you rolling your eyes: “How dare you to compare munis and apartment complexes?! It is a totally different risk profile! Munis are so much safer! Plus you are talking about equity multifamily investing, not debt (which is presumably “safer”)”. Ok, fine, that is fair. No need to roll your eyes. But I do believe that such dramatic difference in potential return more than fairly compensates one for the risk taken. That’s a perfect example of an attractive risk-reward. At the very least, I feel much more comfortable with “value-add” multifamily investing than today’s High Yield bonds. Let’s say an average multifamily investment is an equivalent of a “B” credit profile bond (an educated guess based on interest coverage ratio, debt levels and single asset profile) – average B-rated bond effective yield (pre-tax!) is only 6.5% compared with 13-15% tax-equivalent yield on multifamily deals.

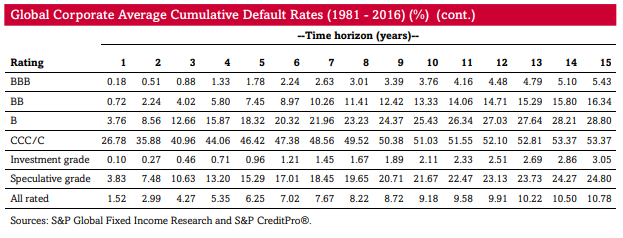

Even the riskiest bonds (CCC and lower) trade at the average 9.85% yield (with over 45% of those bonds typically defaulting within a five-year period, see S&P table below). I would argue all day long that the defaults on well-managed multifamily deals are much much lower and you are much better off in terms of risk-reward as an equity investor in a conservatively underwritten multifamily deal than a bond investor in a CCC paper. I cannot find a table to back this up, so please don’t quote me on that, but I remember hearing that during the last recession, the multifamily default rates were around 4% nationally.

In short, multifamily investing done right is attractive on a relative as well as absolute basis. The only reason I can think of why it is not more popular, it is because it is not easily available to most retail investors – typically, you have to meet SEC requirements for a so-called “accredited investor” (or at least “sophisticated investor”) and that limits accessibility of private investment opportunities to a broader public.

Are you interested in learning more about multifamily real estate investing? Our team of experienced professionals is here to help. Whether you’re looking for advice on conducting market research or need assistance in identifying the best investment opportunities, we have the knowledge and expertise to guide you through the process. Subscribe to our YouTube channel to access informative videos and expert discussions on multifamily real estate investing. Follow us on Instagram for inspiring visuals and exclusive content. Check out our new customized ChatGPTs: Real Estate Investing Coach and Real Estate. Ready to elevate your real estate investment journey? Contact us now to schedule a consultation and take the first step towards achieving your financial goals in the multifamily real estate industry.