In this post we wanted to discuss why multifamily fundamentals are currently favorable and expected to remain so in the long run. Here it goes:

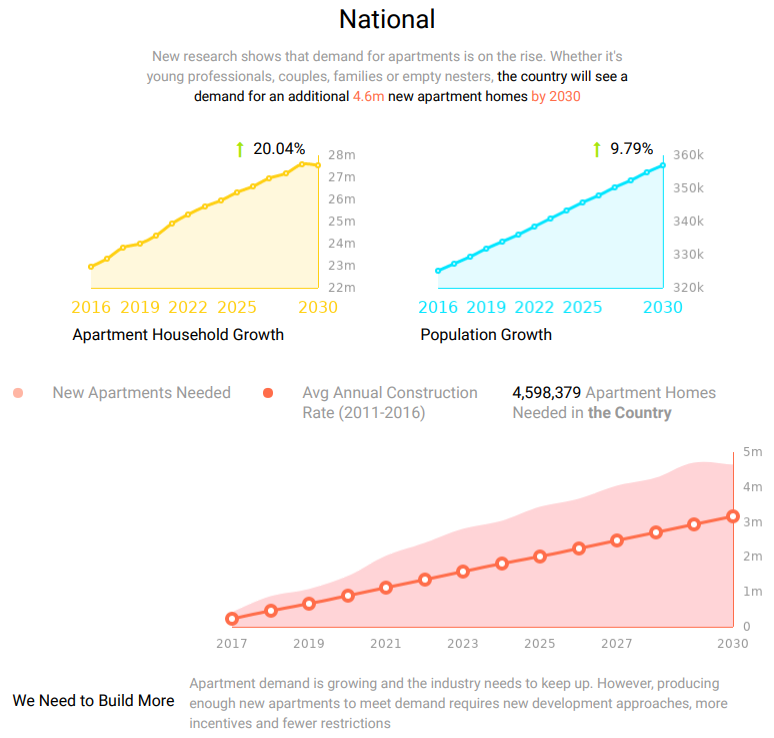

Demand for the apartments is on the rise due to a number of factors: (1) millennials prefer the flexibility of renting and delaying marriage, (2) the number of 55-plus renters is on the rise, (3) immigration trends.

According to WeAreApartments https://www.weareapartments.org/, the demand for rental housing will reach 4.6mm units by 2030:

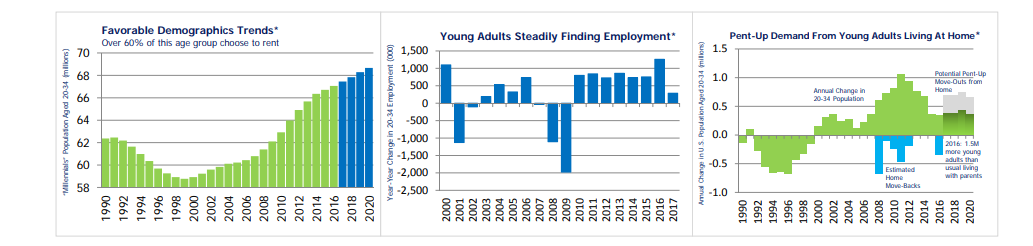

Another set of charts, provided in Camden Property Trust’s investor presentation (Source: Whitten Advisors), also supports the “Millenials” thesis. Not only millennials have high propensity to rent, a large share of jobs is also going to the 20-34 age cohort. Additionally, the increasing number young adults living at home or with roommates creates a potential pent-up demand as well:

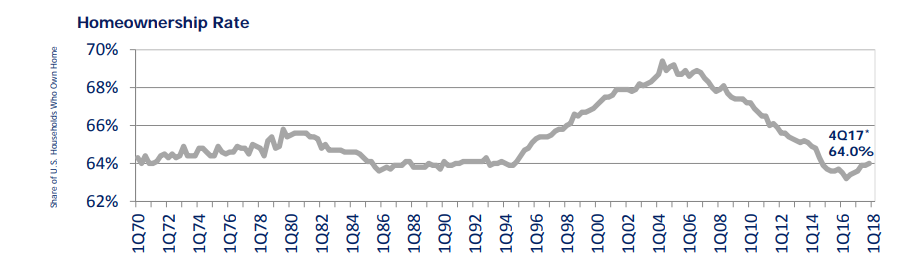

At the same time, the homeownerhip rate – the percentage of households that own rather than rent the homes that they live in—has fallen sharply since mid-2005. There could be many reasons for that. Jobs are becoming more transient, student debt carried by young adults is significant, access to credit after the Great Recession is more limited:

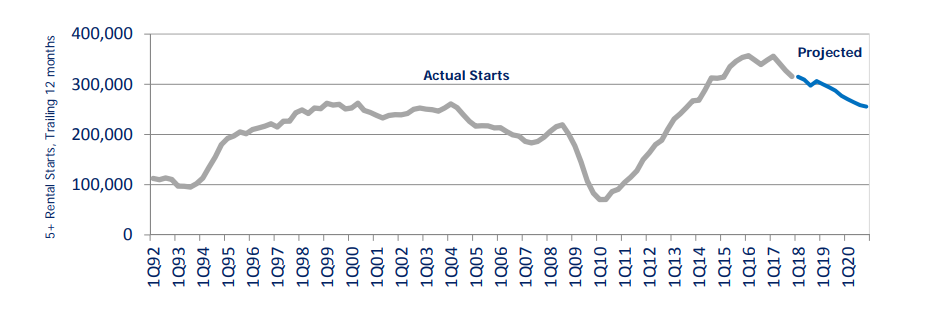

The supply of multifamily units, on the other side, seems to be on the decline after multifamily starts peaked in 2016. Rising construction costs and reduced availability of construction loans make future development starts more challenging:

The trends favoring multifamily are expected to persist in the future as population grows, especially in the markets where jobs are created and homeownership is least affordable. The pockets of overbuilding of course can depress occupancy and investors should always be cautious, however most of the newly created product tends to be Class A properties and not Class B/C, which tends to perform better in a downturn (some Class A tenants trade down to Class B during recessions, etc) and is SunSail Capital area of focus.

Are you interested in learning more about multifamily real estate investing? Our team of experienced professionals is here to help. Whether you’re looking for advice on conducting market research or need assistance in identifying the best investment opportunities, we have the knowledge and expertise to guide you through the process. Subscribe to our YouTube channel to access informative videos and expert discussions on multifamily real estate investing. Follow us on Instagram for inspiring visuals and exclusive content. Check out our new customized ChatGPTs: Real Estate Investing Coach and Real Estate. Ready to elevate your real estate investment journey? Contact us now to schedule a consultation and take the first step towards achieving your financial goals in the multifamily real estate industry.