In the latest issue of National Real Estate Investor there was an article discussing where the rich people (a.k.a. High Net Worth Individuals, “HNWIs”) invest their money.

According to the survey conducted by Capgemini, real estate is the third largest asset class for HNWIs, accounting for 16.8% of their assets.

Interestingly, only 15.4% of that “pie” is allocated to commercial real estate – the rest is in other types of real estate assets – residential, hotels, land, REITs, etc. Also, not surprisingly, Multifamily was named by 76% of the respondents as the #1 preferred property type in the commercial real estate category (followed by Industrial at ~47%).

Why is Multifamily favored by so many?

First, on a relative basis, it is a winner in terms of returns. Even though the return expectations have come down over the last year, value-add multifamily deals still often generate 7-8% cash-on-cash returns (with great tax benefits too) and 15%+ IRR over the life of a deal. As compared to the other assets classes, multifamily offers materially higher return.

The cover story of the latest Barron’s magazine talked about best income investments for 2019. Return-wise, none of them come close to what a multifamily investment can deliver, especially considering embedded tax advantages that real estate provides. 3% dividend stocks, 6% preferreds, treasuries. Come on… How exciting is that?! Some MLPs with 8-9% yields are probably the only comparable instrument return-wise, but still come short. And MLPs are correlated to oil/gas prices when the times are bad. Do you want that risk? Anyway… I digress. Of course, we are not saying one should completely avoid stocks and bonds. They are obviously more liquid and have a place in an investment portfolio. What we ARE saying though, that multifamily is probably a better investment on a risk-reward basis. Real estate in general as an industry is much more predictable than most others. You have historical data available at your fingerprints and there’s much more visibility and cash flow predictability.

Second, historically multifamily loans have demonstrated solid performance with low default rates.

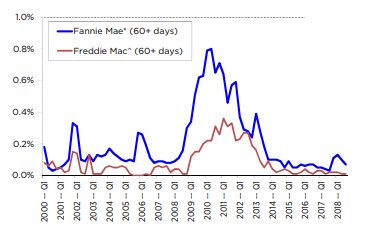

As you can see from the charts below, the default rates on Fannie and Freddie multifamily loans (and they finance ~55% of them) were very low in the last recession (less than 1%). Banks, which comprise about 25% more of the multifamily loan volume, had default rates that peaked at about 4.5%.

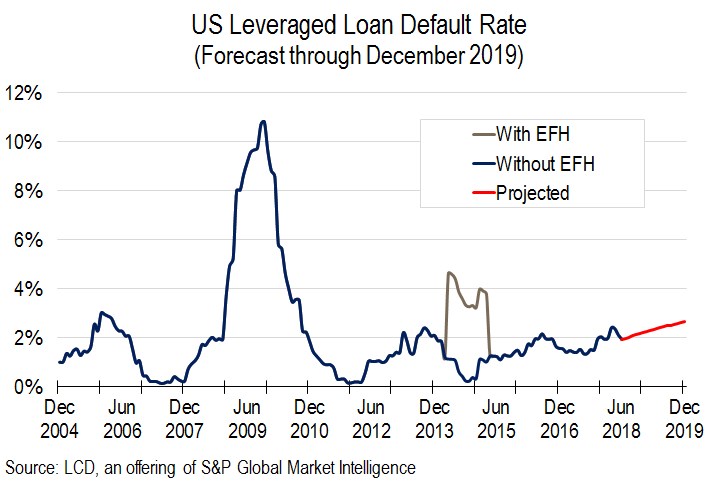

For comparison, US leveraged loans had about 11% peak default rate in the last recession.

Thus, multifamily real estate still a very compelling investment on a risk-reward basis and certainly is one of the most predictable ways for long term wealth accumulation.

As always, feel free to reach out with any questions, comments, thoughts!

Cheers,

Julia

Are you interested in learning more about multifamily real estate investing? Our team of experienced professionals is here to help. Whether you’re looking for advice on conducting market research or need assistance in identifying the best investment opportunities, we have the knowledge and expertise to guide you through the process. Subscribe to our YouTube channel to access informative videos and expert discussions on multifamily real estate investing. Follow us on Instagram for inspiring visuals and exclusive content. Check out our new customized ChatGPTs: Real Estate Investing Coach and Real Estate. Ready to elevate your real estate investment journey? Contact us now to schedule a consultation and take the first step towards achieving your financial goals in the multifamily real estate industry.