In a recent Op-Ed article that appeared in the WSJ, the authors Arthur Laffer and Stephen Moore offer an interesting perspective on the potential impact of Trump tax bill’s cap on the deduction of state and local tax on the migration patters across the US. If what they are saying does in fact materialize, it could potentially be very beneficial for many multifamily markets.

According to the excerpt below, the authors expect New York and California residents to leave those states in droves:

“Now that the SALT subsidy is gone, how bad will it get for high-tax blue states? Very bad. We estimate, based on the historical relationship between tax rates and migration patterns, that both California and New York will lose on net about 800,000 residents over the next three years—roughly twice the number that left from 2014-16. Our calculations suggest that Connecticut, New Jersey and Minnesota combined will hemorrhage another roughly 500,000 people in the same period.”

The full article could be found here: https://www.wsj.com/articles/so-long-california-sayonara-new-york-1524611900

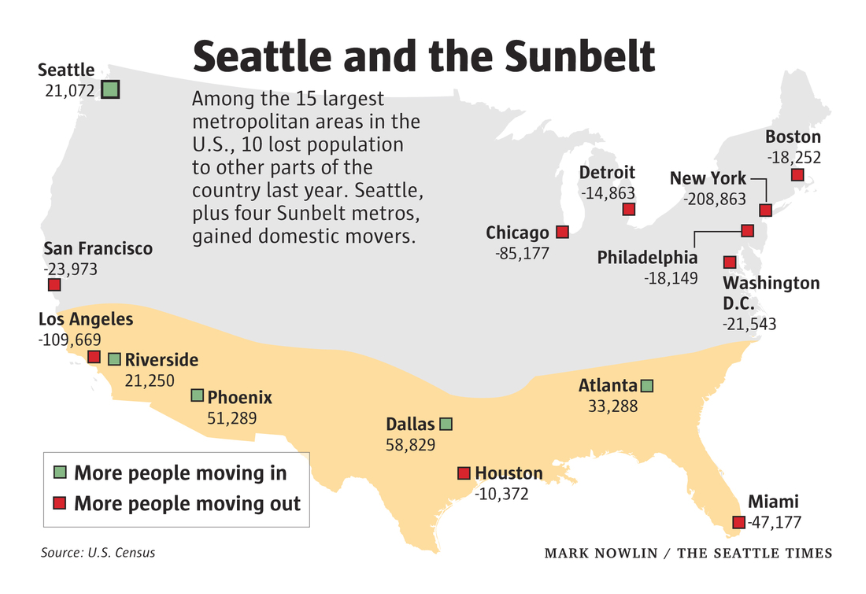

Another recent article in The Seattle Times https://www.seattletimes.com/seattle-news/data/seattle-just-one-of-5-big-metros-last-year-that-had-more-people-move-here-than-leave-census-data-show/ also talks about how people have been moving to the Sunbelt states (and now Seattle too) for years from New York, Los Angeles, Chicago and other large metros.

Are you interested in learning more about multifamily real estate investing? Our team of experienced professionals is here to help. Whether you’re looking for advice on conducting market research or need assistance in identifying the best investment opportunities, we have the knowledge and expertise to guide you through the process. Subscribe to our YouTube channel to access informative videos and expert discussions on multifamily real estate investing. Follow us on Instagram for inspiring visuals and exclusive content. Check out our new customized ChatGPTs: Real Estate Investing Coach and Real Estate. Ready to elevate your real estate investment journey? Contact us now to schedule a consultation and take the first step towards achieving your financial goals in the multifamily real estate industry.